When HP intended to acquire EDS in 2008, I wrote a post titled: Vendors Survival: Will HP Survive Until 2018? - HP's EDS First Take.

The prefix implies that the post was not the only post about Vendors Survival. Other posts discuss future survival of other vendors such as Microsoft, Apple, Google, SUN and EMC.

The optimistic view was that HP will become a co-leader of the Outsourcing market together with IBM (The market leader). The idea was to get more revenues from the profitable Service market, because Hardware commoditization reduced Hardware profitability.

However, my opinion was, that the optimistic view was less realistic than other scenarios.

It looks like my prediction was not far from reality.

HP Layoffs in 2012

On May, 23 2012, HP announced that it is cutting 27,000 jobs after posting a profit decline of 31%in the second quarter of 2012. Many of the jobs cut where former EDS employees.

The Case of General Motors (GM)

On November 2012, HP agreed to transfer 3,000 of its employees to GM. GM is moving its IT services in house instead of Outsourcing to EDS, which is Outsourcing to HP after EDS acquisition by HP.

Outsourcing was EDS main Line of Business.

GM was a unique EDS Outsourcing client.

It is one of the largest clients, but the EDS tight relations with GM were not based on size only.

The company which was founded by Ross Perot, was acquired on 1984 by one of its clients. The client was GM. In 1996 it was spunned off as an independent company.

I worked together with EDS in a large project they executed for one of my clients.

many of their examples and Best Practices were based on GM projects.

My conclusion is that loosing GM Outsourcing is a stamp of the failure of EDS acquisition by HP.

Final Notes

1. It is impossible to separate the EDS acquisition from HP management practices. For example, If it would not profit less on the second quarter of 2012, it may cut less jobs or not cut jobs at all.

2. Changes in Outsourcing market trends also influence the EDS deal consequences. Cloud Computing influences Outsourcing negatively.

The giant Indian Outsources prices are lower than HP's prices.

3. Outsourcing deals face new challenges due to the frequent Business and Technological changes. Adaptation of the Service-level Agreements to changes, including pricing adaptation, could be a barrier to Win-Win Outsourcing deals.

4. Will HP survive until 2021? The probability that it survive is still high, but I am less optimistic than I was on 2008.

Blog on SOA, Cloud Computing and other IT architectural issues, technologies and trends.

Sunday, November 11, 2012

Thursday, October 4, 2012

BPMS Next Generation: IBPMS

In a previous post I discussed Business Process Management (BPM) evolution as reflected by an Ovum report.

Recently I read new Gartner BPM Magic Quadrant. The Magic Quadrant is titled IBPMS Magic Quadrant.

If you compare it to previous Gartner BPMS Magic Quadrants (you should not compare them), you will find a totally different picture.

Only three Leaders in the IBPMS Magic Quadrant, namely: IBM, PegaSystems and Appian. No Challengers and a lot of Visionaries I know (Oracle, Software AG, Tibco, Vitria) and two Visionaries I never heard of (Bosch Software Innovations, Whitestein).

Previous BPMS Magic Quadrant includes many Leaders, many Challengers as well as many Visionaries.

The pattern of few Leaders, No Challengers and many Visionaries is typical to immature markets.

Gartner explains it as a new generation of BPMS tools.

What differentiate IBPMS from BPMS?

IBPMS tools try to address a new Use Case: Intelligent Business Operations(IBO). IBO is required for better and faster decisions in a dynamic ever changing enterprise.

The implication of the IBO Scenario is convergence (or at list tighter binding) of BPM with other paradigms and technologies. The word Intelligent included in the IBO acronym implies that Business Intelligence (BI) is one of the related technologies. SOA which was already coupled with BPM is more connected to BPM in the context of IBPMS. Complex Event Processing, Service Orchestration, ESBs and Registries are SOA and EDA concepts and technologies, which are closely related to IBPMS implementation.

MY Take

Recently I read new Gartner BPM Magic Quadrant. The Magic Quadrant is titled IBPMS Magic Quadrant.

If you compare it to previous Gartner BPMS Magic Quadrants (you should not compare them), you will find a totally different picture.

Only three Leaders in the IBPMS Magic Quadrant, namely: IBM, PegaSystems and Appian. No Challengers and a lot of Visionaries I know (Oracle, Software AG, Tibco, Vitria) and two Visionaries I never heard of (Bosch Software Innovations, Whitestein).

Previous BPMS Magic Quadrant includes many Leaders, many Challengers as well as many Visionaries.

The pattern of few Leaders, No Challengers and many Visionaries is typical to immature markets.

Gartner explains it as a new generation of BPMS tools.

What differentiate IBPMS from BPMS?

IBPMS tools try to address a new Use Case: Intelligent Business Operations(IBO). IBO is required for better and faster decisions in a dynamic ever changing enterprise.

The implication of the IBO Scenario is convergence (or at list tighter binding) of BPM with other paradigms and technologies. The word Intelligent included in the IBO acronym implies that Business Intelligence (BI) is one of the related technologies. SOA which was already coupled with BPM is more connected to BPM in the context of IBPMS. Complex Event Processing, Service Orchestration, ESBs and Registries are SOA and EDA concepts and technologies, which are closely related to IBPMS implementation.

MY Take

- I already read and wrote about IBO. Few months ago I wrote a new Business Intelligence Kit to be included in the next version of MethodA. I met this concept while drilling down BI. Gartner's Magic Quadrant starting point was BPMS.

- Gartner's view of a new generation of BPMS is different from Ovum's gradual evolution approach. However, you can find the same Vendors as Leaders (Gartner) or Shortlist (Ovum): Appian, PegaSystems and IBM. Ovum's Shortlist also includes Oracle. Probably PegaSystems's, Appian's and IBM's products are currently better products than other products.

- Product selection is specific to an Enterprise. Enterprises differ in Size, Use Cases, Technological Infrastructure, Applications Technologies etc. Sometimes a Niche product or Visionary product and not a leading product is the best fit for an Enterprise.

- Expect changes in an Immature markets like IBPMS. Today Leaders will not necessarily be tomorrow (2013 or 2014) leaders.

- Not all BPMS products are created equal. Gartner divides them to two major categories: Pure BPMS Products (e.g. Appian, PegaSystems and Bosch Software Innovations) and Infrastructure Products including BPMS (e.g. IBM, Oracle, Software AG and Tibco).

- IBPMS and Case Management There are similarities between IBPMS and Case Management but they address different Use Cases. Case Management and IBPMS converge between BPM and other concepts and technologies. However, Case Management is for Knowledge Workers and IBPMS is usually for Managers tasks (sometimes it is also for Knowledge Workers). Some of the technologies included in Case Management such as Knowledge Management and Enterprise Content Management are not integral part of IBPMS.

Thursday, August 30, 2012

BPM market Growing Rapidly but still Maturing and changing

Why SOA is implemented by more enterprises than BPM?

SOA is an Architecture, so an enterprise may use an Architecture or not.

Many Enterprises without any architecture, begin their SOA initiative, when SOA was only Hype and buzzword. Other Enterprises followed when it matured. Some realized measurable SOA benefits.

Unfortunately, many of them executed it wrongly, and therefore their SOA benefits were limited or even non-existent.

Managing Business Processes is not an option it is a must. Therefore Enterprises managed their Processes manually or by usage of code embedded in Systems' Business Logic Layer.

It is difficult to convince them to change their Process Management practices by implementing BPM.

The company's management team may use the slogan: If it is not broken do not fix it.

The significant value of BPM is not Business Process Automation. It is Business Process Change or Improvement or Flexibility.

In order to change a Business Process, usually you need to automate it before changing it. Therefore BPM benefits are Long Term benefits.

It is more difficult to convince managers to spend resources when the predicted Return on Investment and the predicted benefits are Long Term.

SOA is already a Mainstream architecture, while BPM is still a rapidly growing and evolving market in 2011 and 2012.

According to Ovum's Research Note, published in December 2011 "BPM is a rapidly growing market and high double digit revenues growth figures are very common among leading vendors profiled in this report".

I recommend reading the full report written by Somak Roy and titled:Decision matrix: Selecting a Business Process Management Vendor.

In this post, I will discuss a limited number of topics appearing in that report.

The Vendors

Ovum view is that there are twelve leading vendors. Ovum divides them to the following categories:

1. Shortlist: Appian, IBM, Oracle and Pegasystems

2. Consider: Tibco,Cordys, Active Endpoints, Newgen, AuraPortal

3. Explore: SAP, EMC, Bonitasoft

There are new vendors in the list, replacing vendors appearing in previous similar Research Note. The change of the leaders list could be a sign of limited maturity of the BPM market.

Case Management

According to Ovum, Case Management is a major Focus area for most vendors.

It is not surprising. Vendors solutions, as well as BPM implementations, begin with handling automated Processes (SOA Processes). The next phase is adressing Human Processes and finally the less structured Processes, i.e. Case Management Processes, are the focus area.

SaaS

BPM is not the best fit for SaaS. BPM Engine infrastructure requirements are limited. Usually, BPM implementations invoke Systems and/or Services and the amount of code and data in them is minimal.

The main issue is Business Alignment, which has nothing to do with Cloud Computing.

Ovum believes that Cloud Computing will not be the dominant delivery model.

Social Software Concepts

Social is trendy, so it is possible to find Social concepts in most of the BPM products. However, currently they are important mainly in Case Management context.

Open Source

Bonitasoft is the only Open Source vendor included in Ovum list. Intalio, the Open Source BPM traditional leader is not included. According to Ovum, most vendors did not mentioned it as a competitor.

If Ovum's view will be verified by other sources, then the emergence of a new Open Source BPM leader could be an indication of BPM immaturity.

SOA is an Architecture, so an enterprise may use an Architecture or not.

Many Enterprises without any architecture, begin their SOA initiative, when SOA was only Hype and buzzword. Other Enterprises followed when it matured. Some realized measurable SOA benefits.

Unfortunately, many of them executed it wrongly, and therefore their SOA benefits were limited or even non-existent.

Managing Business Processes is not an option it is a must. Therefore Enterprises managed their Processes manually or by usage of code embedded in Systems' Business Logic Layer.

It is difficult to convince them to change their Process Management practices by implementing BPM.

The company's management team may use the slogan: If it is not broken do not fix it.

The significant value of BPM is not Business Process Automation. It is Business Process Change or Improvement or Flexibility.

In order to change a Business Process, usually you need to automate it before changing it. Therefore BPM benefits are Long Term benefits.

It is more difficult to convince managers to spend resources when the predicted Return on Investment and the predicted benefits are Long Term.

SOA is already a Mainstream architecture, while BPM is still a rapidly growing and evolving market in 2011 and 2012.

According to Ovum's Research Note, published in December 2011 "BPM is a rapidly growing market and high double digit revenues growth figures are very common among leading vendors profiled in this report".

I recommend reading the full report written by Somak Roy and titled:Decision matrix: Selecting a Business Process Management Vendor.

In this post, I will discuss a limited number of topics appearing in that report.

The Vendors

Ovum view is that there are twelve leading vendors. Ovum divides them to the following categories:

1. Shortlist: Appian, IBM, Oracle and Pegasystems

2. Consider: Tibco,Cordys, Active Endpoints, Newgen, AuraPortal

3. Explore: SAP, EMC, Bonitasoft

There are new vendors in the list, replacing vendors appearing in previous similar Research Note. The change of the leaders list could be a sign of limited maturity of the BPM market.

Case Management

According to Ovum, Case Management is a major Focus area for most vendors.

It is not surprising. Vendors solutions, as well as BPM implementations, begin with handling automated Processes (SOA Processes). The next phase is adressing Human Processes and finally the less structured Processes, i.e. Case Management Processes, are the focus area.

SaaS

BPM is not the best fit for SaaS. BPM Engine infrastructure requirements are limited. Usually, BPM implementations invoke Systems and/or Services and the amount of code and data in them is minimal.

The main issue is Business Alignment, which has nothing to do with Cloud Computing.

Ovum believes that Cloud Computing will not be the dominant delivery model.

Social Software Concepts

Social is trendy, so it is possible to find Social concepts in most of the BPM products. However, currently they are important mainly in Case Management context.

Open Source

Bonitasoft is the only Open Source vendor included in Ovum list. Intalio, the Open Source BPM traditional leader is not included. According to Ovum, most vendors did not mentioned it as a competitor.

If Ovum's view will be verified by other sources, then the emergence of a new Open Source BPM leader could be an indication of BPM immaturity.

MY Take

- The question: Which BPMS Vendors were not included in Ovum's analysis? is as interesting as listing and comparing the twelve vendors included. I was surprised that Software AG was not included. I usually find it among the Leaders in Gartner's Magic Quadrant and in Forrester's BPMS Wave.

- Cloud based BPM could be a major deleivery model

- Not all BPMs products were created equal

For some use cases they will be better fit than the Leaders or Shortlist vendors in Ovum terminology.

For example, Active Endpoints's ActiveVOS suite is excellent solution for Straight-through Processes.

Fujitsu's Interstage could be a good fit for large enterprises especially in the Japanese market.

Thursday, August 9, 2012

The mainframe: still alive and kicking

Recently, I was interviewed by Pcon (unfortunately the link points to an Hebrew only site) as part of debriefing on Legacy Systems.

Pcon is an Israeli company investigating IT topics by quoting professional articles and interviewing experts.

They publish the results of the investigations including practical recommendations.

This post is mainly about topics raised by me during the interview, but not included in the debriefing, which will be published.

What are Legacy Systems?

The term Legacy Systems refers to old application systems and/or veteran technologies still in use.

Usually, the term Legacy Systems is associated with:

1. Mainframe Hardware e.g. IBM System z and its Operating Systems or Proprietary Servers and Operating Systems such as HP Alpha and OpenVMS Operating System, IBM AS/400 and OS/400 Operating System.

2. Development and Production Environments, e.g. COBOL, Natural and DBMS systems such as Adabas and IDMS executing on Mainframes or Proprietary Servers infrastructure with proprietary Development and Production Environments.

3. Applications Systems developed more than ten years ago executing in the infrastructure environments cited above using the IDEs and DBMS Systems cited above.

It is true that often Infrastructure and Applications, cited above are Legacy Systems, however there are also Legacy Systems using other technologies such as Visual Basic version 6 or older, old Java technologies and old Windows Operating Systems or extincted UNIX Operating Systems.

In this post i limit the term Legacy Systems to IBM Mainframe systems.

Why investigating Legacy Systems?

The main reason is that these systems are used by many enterprises.

The systems are not only frequently used, they are used for Business critical Processes and Transactions and store and manipulate critical Data.

The second reason is that these systems are no longer Mainstream, as far as new systems buying or building is concerned.

Young people knowledge of theses systems technologies, architectures and concepts is usually limited.

The young generation is not ready to learn about these systems and prefer newer concepts and technologies.

This is the third reason to investigate: limited availability of Legacy Systems skilled professional, which raise the question: why not migrating to other environments before lack of skilled professionals availability will be a crucial problem?

So why not migrating to other environments?

For some enterprises, the question above is a good question and the answer is positive they should migrate from Mainframes to other platform.

Other enterprises have good arguments for avoiding migration.

The following list depict some reasons for not migrating:

1. If it is not broken do not fix it.

2. Replacing Legacy Systems by other systems is expensive and will take long time.

3. Probably, some of the team members should be replaced because they will not make the transition to a new system, new infrastructure and new methods.

The down side is losing their experience and their knowledge (especially non-technical knowledge of the Business, the Organizational Culture and the practices.).

Is it possible to identify those who should migrate and those who should not?

Yes it is. Size Matters. Usually Small Enterprises are better migration candidates than Large Enterprises.

Small Enterprises will not face Scalability issues and Performance issues.

They also pay more relatively to their size, because Mainframe Hardware and Software prices are skewed in favour of Large Enterprises.

They will not have to hire a large number of people to support large number of Servers as Large Enterprises will have to.

Large Enterprises usually operates more Application Systems and their Application Systems are more complex, so the migration will be prone to more errors and failures and will cost more.

Another discriminating factor is the Operating System.

Large Enterprises use IBM's Mainframe flagship Operating System z/OS. Some Small Enterprises use the declining z/VSE Operating System.

Some of the Independent Software Vendors stop support or new versions development of VSE software products. Other minimized their development efforts and current versions support.

The future seems even gloomier because the deteriorating VSE installation base.

Is IaaS a Game Changing Technology?

IaaS looks like a game changing. Users of Operating Systems such as Windows and Linux can lower their TCO by moving part of the Data Center or the whole Data Center to the Public Cloud. Mainframe users can not.

Most Large Enterprise will not move their Core Systems to a Public Cloud in the following two or three years, but SMBs are candidates for moving soon their systems to the Public Cloud.

This trend could be another catalyst for Small Mainframe sites to migrate to Windows, Linux or UNIX.

However, IaaS also change another prevailed concept of running Infrastructure and Systems within the Enterprise boundaries, i.e. its Data Center or Data Centers.

The Public Cloud age, change this concept: You no longer need to own and maintain the physical infrastructure (very similar to the concept of not placing Electricity Generators in every house).

Lower TCO based on getting rid from Data Center Servers is a challenge for Small Mainframe installations, but it is also an opportunity to save the migration efforts, by moving their Application Systems

to a larger Mainframe user premises and lowering the TCO as well. Larger Enterprises can assign Virtual Mainframe Servers to Smaller Enterprises.

Related Posts in my Blog

Mainframe and the Dinosauraus Myth Revisited

IBM z/Enterprise First Take: Data Center in a Box or Cloud Computing

Vendors Survival: Will Software AG Survive until 2019?

Pcon is an Israeli company investigating IT topics by quoting professional articles and interviewing experts.

They publish the results of the investigations including practical recommendations.

This post is mainly about topics raised by me during the interview, but not included in the debriefing, which will be published.

What are Legacy Systems?

The term Legacy Systems refers to old application systems and/or veteran technologies still in use.

Usually, the term Legacy Systems is associated with:

1. Mainframe Hardware e.g. IBM System z and its Operating Systems or Proprietary Servers and Operating Systems such as HP Alpha and OpenVMS Operating System, IBM AS/400 and OS/400 Operating System.

2. Development and Production Environments, e.g. COBOL, Natural and DBMS systems such as Adabas and IDMS executing on Mainframes or Proprietary Servers infrastructure with proprietary Development and Production Environments.

3. Applications Systems developed more than ten years ago executing in the infrastructure environments cited above using the IDEs and DBMS Systems cited above.

It is true that often Infrastructure and Applications, cited above are Legacy Systems, however there are also Legacy Systems using other technologies such as Visual Basic version 6 or older, old Java technologies and old Windows Operating Systems or extincted UNIX Operating Systems.

In this post i limit the term Legacy Systems to IBM Mainframe systems.

Why investigating Legacy Systems?

The main reason is that these systems are used by many enterprises.

The systems are not only frequently used, they are used for Business critical Processes and Transactions and store and manipulate critical Data.

The second reason is that these systems are no longer Mainstream, as far as new systems buying or building is concerned.

Young people knowledge of theses systems technologies, architectures and concepts is usually limited.

The young generation is not ready to learn about these systems and prefer newer concepts and technologies.

This is the third reason to investigate: limited availability of Legacy Systems skilled professional, which raise the question: why not migrating to other environments before lack of skilled professionals availability will be a crucial problem?

So why not migrating to other environments?

For some enterprises, the question above is a good question and the answer is positive they should migrate from Mainframes to other platform.

Other enterprises have good arguments for avoiding migration.

The following list depict some reasons for not migrating:

1. If it is not broken do not fix it.

2. Replacing Legacy Systems by other systems is expensive and will take long time.

3. Probably, some of the team members should be replaced because they will not make the transition to a new system, new infrastructure and new methods.

The down side is losing their experience and their knowledge (especially non-technical knowledge of the Business, the Organizational Culture and the practices.).

Is it possible to identify those who should migrate and those who should not?

Yes it is. Size Matters. Usually Small Enterprises are better migration candidates than Large Enterprises.

Small Enterprises will not face Scalability issues and Performance issues.

They also pay more relatively to their size, because Mainframe Hardware and Software prices are skewed in favour of Large Enterprises.

They will not have to hire a large number of people to support large number of Servers as Large Enterprises will have to.

Large Enterprises usually operates more Application Systems and their Application Systems are more complex, so the migration will be prone to more errors and failures and will cost more.

Another discriminating factor is the Operating System.

Large Enterprises use IBM's Mainframe flagship Operating System z/OS. Some Small Enterprises use the declining z/VSE Operating System.

Some of the Independent Software Vendors stop support or new versions development of VSE software products. Other minimized their development efforts and current versions support.

The future seems even gloomier because the deteriorating VSE installation base.

Is IaaS a Game Changing Technology?

IaaS looks like a game changing. Users of Operating Systems such as Windows and Linux can lower their TCO by moving part of the Data Center or the whole Data Center to the Public Cloud. Mainframe users can not.

Most Large Enterprise will not move their Core Systems to a Public Cloud in the following two or three years, but SMBs are candidates for moving soon their systems to the Public Cloud.

This trend could be another catalyst for Small Mainframe sites to migrate to Windows, Linux or UNIX.

However, IaaS also change another prevailed concept of running Infrastructure and Systems within the Enterprise boundaries, i.e. its Data Center or Data Centers.

The Public Cloud age, change this concept: You no longer need to own and maintain the physical infrastructure (very similar to the concept of not placing Electricity Generators in every house).

Lower TCO based on getting rid from Data Center Servers is a challenge for Small Mainframe installations, but it is also an opportunity to save the migration efforts, by moving their Application Systems

to a larger Mainframe user premises and lowering the TCO as well. Larger Enterprises can assign Virtual Mainframe Servers to Smaller Enterprises.

Related Posts in my Blog

Mainframe and the Dinosauraus Myth Revisited

IBM z/Enterprise First Take: Data Center in a Box or Cloud Computing

Vendors Survival: Will Software AG Survive until 2019?

Friday, July 20, 2012

Will Microsoft Survive until 2021? - Revisited

A year ago I publishes a post titled: Will Microsoft Survive Until 2021?. According to the post, the probability in 2011, that Microsoft will survive until 2021, was lower than the probability assigned in previous post written in 2008, for its survival for ten years, i.e. until 2018. Some problems mentioned in the 2011 post were its position in the Smart Phone market and it Windows Operating System.

Recently, Microsoft reported Loss after a Write-Down.

The Loss was attributed to its ill-fated acquisition of an Online Advertising company. However, Microsoft's Windows business revenues fell 13% in the fourth fiscal quarter ended June 30th.

The Bottom Line: Although the propability that Microsoft will survive for 10 years is still high, this probability in 2012 is lower than it was in 2011.

Recently, Microsoft reported Loss after a Write-Down.

The Loss was attributed to its ill-fated acquisition of an Online Advertising company. However, Microsoft's Windows business revenues fell 13% in the fourth fiscal quarter ended June 30th.

The Bottom Line: Although the propability that Microsoft will survive for 10 years is still high, this probability in 2012 is lower than it was in 2011.

Sunday, June 3, 2012

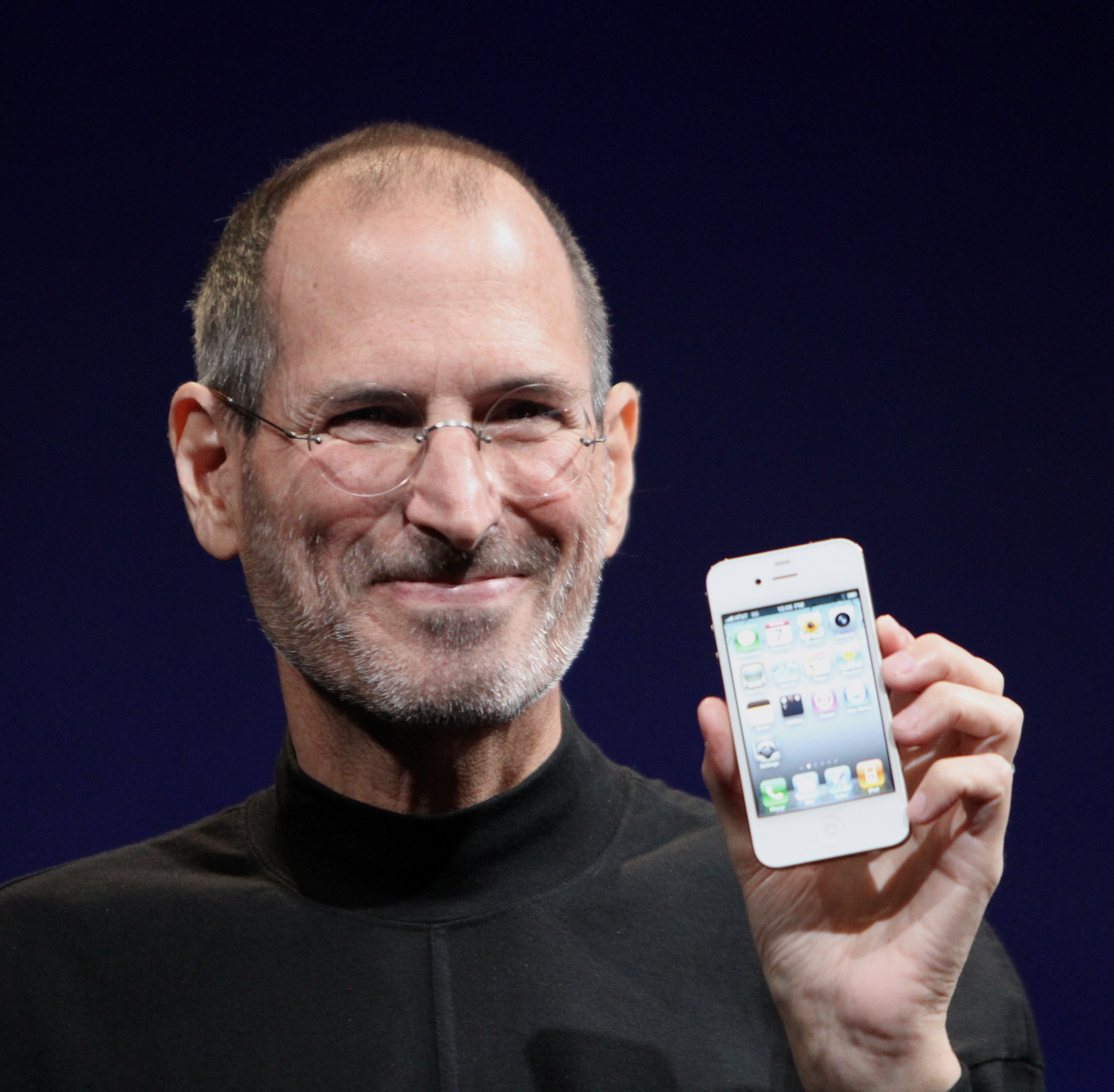

Apple: You can't beat them all

Picture Source: Matt Yohe, orginal loaded to the English Wikipedia

Picture Author: Matt Yohe

In previous post titled: Vendors Survival: Will Apple Survive until 2021? I argued that "that the probability that it will not survive is higher than the probability that the other vendors (not including Software AG and obviously not including SUN) I discussed will not survive."

According to my post, the reasons for assigning lower probability to Apple's existence for 10 years or more included:

1. Apple is a Mountain Train. Its history is full of ups and downs.

2. If it will not continue to innovate, it will not be a leader and even stop surviving.

1. Apple is a Mountain Train. Its history is full of ups and downs.

2. If it will not continue to innovate, it will not be a leader and even stop surviving.

3. Dependence on the late Steve Jobs (When the post was written Jobs was still alive)

A Bloomberg article titled: Apple’s Patent War Seen Leading To Retaliatory Strikes, dwell upon current Apple's Patent Wars. However, interpreting it could support my Long Term analysis.

The additional aspects, discussed in Bloomberg's article and interpreted by me are:

1. Apple is paying 7 or 8 billion USDs a year to

Samsung for components made by Samsung Electronic co.

Apple depends on its rival Samsung. Without Samsung it is not able to supply Smart phones as well as other devices.

2. Suing another company for patent infrigement could result in suing the the suing company for patent infringement of the suied company.

As already described in a previous post titled: Did you find Apple?, Apple is not a leader as far as the number of patents is considered. Samsung is in the second place in the Top Ten 2011 patents Leaders in USA.

Motorola Mobility, acquired by Google, is the Smartphone market Patent leader, i.e. owns the largest number of patents. Apple sued it and HTC in addition to Samsung.

One of the reasons for acquiring Motorola Mobility by Google was the large number of Smart phones patents it owns. As a veteran company, its patents are basic patents. If and when, it will prosecute Apple , the result could be stoppage of sales of Apple's Smartphone , at least for a limited period.

3. Apple's two core products (iPhone and iPad) strategy, is a marketing advantage in comparison to Nokia (as already cited in a previous post) and Samsung, which presents 134 phones in its Web site.

As far as Patent Wars are concerned, it is disadvantage.

If you lose, you will have to stop marketing a product.

If you have 134 phones you can still sale 133.

If you have only two your survival is questionable.

4. Is the Smartphone Operating Systems competition scenario similar to the PC competition scenario few decades ago?

If it is, then the threat of Binding or closed System is a serious one.

Microsoft vs. Apple

It is strange to think of Microsoft's Desktop Operating System as Open, but if you compare it to Apple's Desktop Operating System it is.

Microsoft binding was limited to its Infrastructure Products e.g. Windows Operating System and its Applications e.g. Office.

AS long as you used them, you could use any hardware vendor's products e.g. HP, Dell, IBM, Toshiba etc and any processor supporting Windows.

You could also complement Microsoft's products, with third party or ISVs products.

Apple's binding includes its Hardware and the number and variety of ISVs products was limited.

The result was standardization on Windows and Apple's Desktop Operating systems and Hardware are only Niche Player.

Google vs. Apple

The two leading Smartphone Operating Systems are Iphone OS and Google's Android.

Any Smartphone vendor can use Android freely.

Google business model is based on Advertisement, so many of its products, including Android, are free of charge as long as Google can add Ads.

The result is Android usage by many Smartphone Vendors.

Apple is, as closed as it was, in the Desktop: Only Iphones can use Iphone OS.

If and when, the Smartphone applications market will be standardized on the open Android Operating System Apple's Iphone will be a Niche Player.

Any Smartphone vendor can use Android freely.

Google business model is based on Advertisement, so many of its products, including Android, are free of charge as long as Google can add Ads.

The result is Android usage by many Smartphone Vendors.

Apple is, as closed as it was, in the Desktop: Only Iphones can use Iphone OS.

If and when, the Smartphone applications market will be standardized on the open Android Operating System Apple's Iphone will be a Niche Player.

Thursday, May 17, 2012

The Marriage of Customer Centric and Multi-Channel

One of the main obstacles towards Customer Centric was lack of understanding of the dependency of Customer Centric approach on Multi-Channel Architecture.

Multi-Channel and the Customer

If you are Customer Centric, than a customer should be free to choose his/her preferred Channel.

The conclusion above is obvious to say, but not always easy to execute.

Less obvious, is the conclusions you can derive from the customer's choice.

For example, a Bank customer preferring the Internet channel provided more value than a customer who preffers the Branch Channel.

This conclusion is supported by internal data of successful banks in Europe and USA dated about 10 years ago.

Although, I do not have access to updated data, the hypothesis that this conclusion is still valid, is plausible.

Internet Channel users could use this channel because they are busy working and therefore earn more money. They also may use this channel because they are Internet Natives, i.e. young people.

Young people e.g. students may not be preferred bank customers now, but probably will have higher income and financial resources in the future.

Multi-Channels Architecture

The illustration in the beginning of the post depicts Multi-Channel Architecture in an Enterprise SOA.

All channels share the same Business Services. However, there are also Channel Dependent Services, due to regulations, capabilities and limitations.

The most limited channel, ten years ago, was the Mobile phone.

Its limitations included: low bandwidth, small screen and less than optimal availability.

Some of the channels are used via communication with an employee (e.g. a Bank Branch Channel) and others are Self Service Channels.

As already noted about Internet Channel Bank Customers, Self Service Channel could be attractive to some customers. However, it is also attractive to Companies due to lower costs.

There are many Success Stories of SOA implementations enabling usage of Self Service Channels in addition to traditional Channels.

For example, Sprint-Nextel average Call cost in Self Service Channel was 43 cent instead of 12 USD in other Channels.

Another impressive SOA implementation is Verizon Wireless. The implementation is based upon BEA (now part of Oracle) SOA products. Usage of Self-Service Cellular Phone Channel by millions customers saved multi millions USDs, due to elimination of printing and sending reports by mail.

What was changed in Multi-Channel Architecture?

In my opinion, no fundamental change occurred in Multi-Channel Architecture in the last decade.

The major change was a change in the Mobile devices Channel: opportunities instead of limitation.

Smartphones and other devices applications are able to provide Location Dependent Services and other advanced services.

I guess that a study of Bank Customers Value according to their preferred channel will reveal that Customers preferring Mobile Devices Channel provide more value than other Channels users.

Another change is the possibility to execute parts of Customer - Company interaction from different Channels: For example, the Customer may start the interaction from his home Internet and will receive information and complete the transaction from his Mobile device.

CRM and Multi-Channels

Customer Relationship Management is not only usage of a CRM software.

It is also the way Channels and CRM implementation are integrated.

Unification of Channels is not restricted to the Technological level.

A coherency between Channels is a must.

Sometimes even very basic data such as operations hours is not identical across Channels.

My experience as a Customer

My recent interactions with some companies in my country reveals that these companies do not understand yet what Customer Centric is.

I am referring specifically to TV services providers, ISPs and Mobile Phones services providers.

These markets are dynamic, e.g. ISPs Data Transfer rate is growing quickly.

These vendors products are very complex and different products are available in different Channels.

Customer Centric Multi-Channel approach requires that, the Customer will have access to the same products from all Channels and will not have to compare different products offered in different Channels (most of the Customers are not even capable of comparing the products due to their complelxity).

A Customer Centric Company cannot convince Customers to use Self Service Channels instead of other services by confusing the customers, i.e. offering different products. It may convince them to do so by paying less for the same product.

Sunday, May 6, 2012

Fall is a season not the future of SaaS

I recently read a TechCrunch article titled: The Rise of Big Data Apps and the Fall of SaaS written by Raj De Datta.

I do agree with the prefix. As far as the suffix is concerned, I can only explain why Raj De Datta's opinion is wrong.

I usually tend not to agree with statements about premature End of Life of technologies or architectures or trends.

In most cases, it easier to kill a concept in writing, than to persuade a large number of users to change their habits.

The root of the opinion that Business Logic Centered Applications are in conflict with Data Centered Applications, derived from specialization of IT experts. The approach of experts specialized in Data is different from the approach experts specialized in Applications.

I also read an interesting related Gartner Research Note titled: Overlaps in Data Integration and Application Integration Represent Significant Opportunities. This Research Note written by Gartner's Analysts Ted Friedman and Jess Thompson, was published in November 2011.

According to Friedman and Thompson, Data Integration and Application Integration deploy different approaches but there is a lot of synergy between these Integration types.

Each of these approaches deploy different features (e.g. Modeling Metadata for the Data centric approach and Message based Transformation for the Application Centric approach), but they share many common features such as Communication or Security.

Each of them is related to different Problem Types or Use Cases (e.g. Composite Applications in the Application Centric approach and Data preparation in BI/Analytics for the Data centric approach), but they share common Problem Types and Use Cases such as MDM or SOA Support.

Friedman and Thompson conclude that leveraging the communalities could provide Business Value.

My Take

- As you can see in the illustration in the beginning of this post, Big Data and SaaS are not competing technologies. It is possible to use any variety of data kinds in SaaS services, including Big Data. Big Data Apps, i.e. applications using large amounts of data, could reside in a Public Cloud.

- It may be useful to extend Gartner's analysts, Friedman and Thompson analysis, beyond Integration issues. Combining Raj De Datta's Big Data, Data Centered approach with SaaS (Applications Centric approach) could provide Business Value.

- According to Analyst's Research Notes and predictions, the SaaS market is growing and will continue to grow. You can also read my posts How Hot is Cloud Computing? and Cloud Computing: Hype, Vision or Reality.

- It should be noticed that the boarders between Big Data and other Data are blurred. The boarders between Data Centric applications (Including Big Data Applications) and Business Logic Centric Applications are also blurred

Friday, March 23, 2012

STKI Summit 2012

On March 19th I participated in STKI Summit.

participating in this Israeli Market analysis conference is an habit. I aprticpated in 2011, 2010 and 2008. My consist particiaption indicates that, at least in my opinion, it is a valuable event.

This year theme was IT Revolution Consumer Power.

The Consumer centirc IT revolution is not totally new, it was discussed in previous year Summit Presentations, as one of the driving forces.

I am attaching links to the presentations:

Jimmy Schwarzkopf - IT Market in Israel 2012

Pini Cohen - Trends in Infrastructure: Paradigm Shift

participating in this Israeli Market analysis conference is an habit. I aprticpated in 2011, 2010 and 2008. My consist particiaption indicates that, at least in my opinion, it is a valuable event.

This year theme was IT Revolution Consumer Power.

The Consumer centirc IT revolution is not totally new, it was discussed in previous year Summit Presentations, as one of the driving forces.

I am attaching links to the presentations:

Jimmy Schwarzkopf - IT Market in Israel 2012

Pini Cohen - Trends in Infrastructure: Paradigm Shift

Shahar Geiger Maor - Networking Trends, EndPoints Trends

Einat Shimoni - Trends in Enterprise Applications, Web & Analytics

I did not find a link to the new analyst and Research Assistant Liza Bodogin's presentation on ECM, Talent Training and Social Applications. Probably it is included in Einat Shimoni's presentation.

My Take

Expect Recession in the Israeli market in 2012

I agree with Jimmy Schwarzkopf's coclusion. This conclusion is applicable to the Global market and the Israeli market is part of it. However, Jimmy's Recession Indicator is interesting: every year (including 2012) in which the Public sector market is greater than the Banking sector market is a Recession year in Israel.

I agree with Jimmy Schwarzkopf's coclusion. This conclusion is applicable to the Global market and the Israeli market is part of it. However, Jimmy's Recession Indicator is interesting: every year (including 2012) in which the Public sector market is greater than the Banking sector market is a Recession year in Israel.

The Consumer Revolution is an interesting trend

I would add to what was presented the concept of Personal Cloud used by Gartner and others.

Few years ago I had to carry a Mobile Computer for my presentations. Afterwards I carried Disk Onkey. Now I am sending the presentation to myself in gmail and upload it.

Apple is going to lead nendors pack?

I disagree with Forrester's George Colony cited by Jimmy, as far as Long Term prediction. See my posts:

Few years ago I had to carry a Mobile Computer for my presentations. Afterwards I carried Disk Onkey. Now I am sending the presentation to myself in gmail and upload it.

Apple is going to lead nendors pack?

I disagree with Forrester's George Colony cited by Jimmy, as far as Long Term prediction. See my posts:

Did you find Apple? , Vendors Survival: Will Apple survive until 2021? and A Quarter is not a Long Term Indicator

Very limited Cloud Computing and SaaS market in Israel

This evidence was discussed by Pini Cohen (Infrastructure) and Einat Shimoni (Applications).

It is a pitty that Israeli Enterprises especially SMBs are not using SaaS and other Public Cloud Services more than they do. Some of the benefits were discussed in my posts ERP as SaaS Maturity indicator, SaaS is going Mainstream, Future applications: SaaS or traditional?

Saturday, March 17, 2012

ERP as SaaS Maturity indicator

I recently read Tien Tzue's post titled The End of ERP. As usual, I suspect the validity of statements beginning with the End of ... without a question mark in the end. Tien Tzue's statement is not an exception.

According to Tien Tzue there is a shift from 20th century products based economy to 21th century Service subscription economy, therefore ERP is doomed. He refers to the acquisitions of Cloud ERP solutions companies, Successful Factors by SAP and Taleo by Oracle, as an End Of Life signs of traditional ERP.

No ERP company can afford to ignore Cloud based ERP, but that does not mean that SAP, Oracle and other traditional vendor, are going to kill the goose who lays golden eggs i.e. their traditional On-Premise ERP suits.

SaaS based ERP is a better fit for some enterprises and Traditional ERP fits better for other enterprises.

Three years ago I already discussed the issue of Future Applications: SaaS or Traditional.

Basically it is a tradeoff between Maturity and Robust Functionality (Traditional On-Premise ERP suits) and Agility (SaaS based ERP suits).

What was changed since 2009?

- Many SaaS ERP vendors instead of few

Today SalesForce.com and Netsuite are still the dominant vendors, but there are many other full SaaS ERP suits vendors.

Workday is no longer an HR only vendor. The SaaS ERP Suits vendors list includes: Infor, Intacct, Epicor (Architecturally, it is my favorite due to its innovative approach and full SOA support) etc.

- SalesForce.com and Netsuite are the "SAP" and "Oracle" of the SaaS based ERP market.

Netsuite nickname is "Little Oracle". The nickname is dew to Netsuite's investor Larry Ellison, the similar Corporate Cultures and a lot of past Oracle's employees employed by Netsuite.

Netsuite is building a full SaaS ERP suite.

Saleforce.com, the leading SaaS CRM vendor, is building an ERP PaaS environment named Force.com Development Environment. SaaS ERP vendors such as Infor use it for developing their products and are Salesforce.com's Value Added Resellers (VARs).

I will not be surprised if SalesForce.com will acquire one of these resellers.

- Growing SaaS ERP market share

- SaaS ERP is not adequate yet for Large and Complex Enterprises.

My Take

The patterns of SaaS ERP adoption are a major indicator of SaaS Maturity Level.

If and when, most large and complex enterprises will deploy SaaS ERP then it will reach high Maturity Level.

The future deployment by Large Enterprises cited above, should include all, or at least, most Core ERP components. Currently, Large Enterprises implement SaaS CRM and SaaS HR, but most frequently use On-Premise Traditional ERP for core components implementations.

Only when SaaS Maturity will reach this high level, we can start dwelling upon The End of Traditional ERP.

In my opinion it will take a long time.

Subscribe to:

Posts (Atom)

Public Cloud Core Banking: Hype or Reality? - Revisited

More than 4 years ago I was asked if Public Cloud Core Banking is a Hype or a Short Term Reality? If you had read the post, you would prob...

-

Is Software Problem Determination a Logical or Scientific process based on cause analysis and repeatable observation or is it a Zen style a...

-

Why SOA is implemented by more enterprises than BPM ? SOA is an Architecture, so an enterprise may use an Architecture or not. Many Ente...

-

Recently, I was interviewed by Pcon (unfortunately the link points to an Hebrew only site) as part of debriefing on Legacy Systems. Pcon...